The Pan-African Financial Internet — to unlock seamless trade, payments, and financial inclusion across Africa.

Who We Are

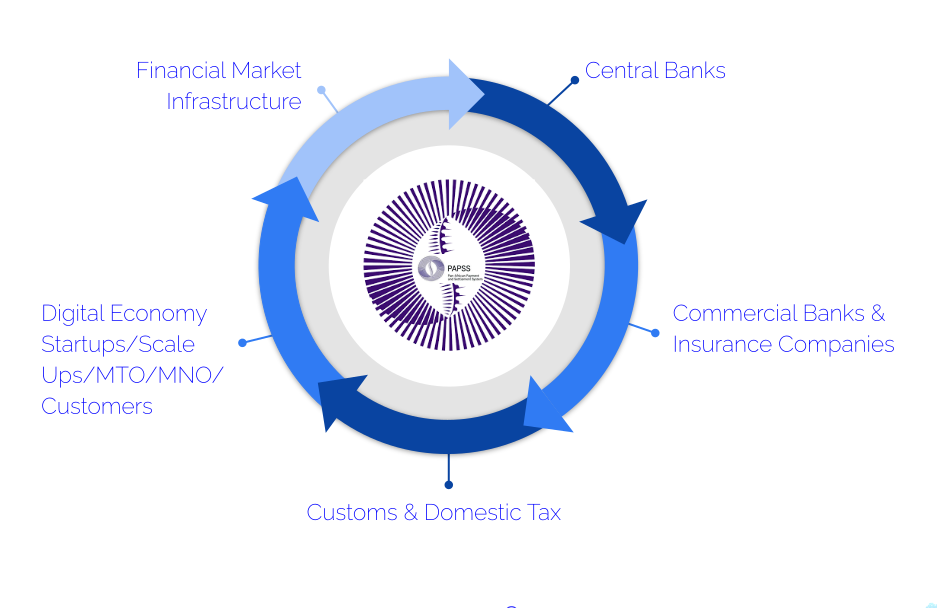

SAPA is at the center of Payments & Trade

Infrastructure Modernization Layer across the Africa cluster.

Our Origin

Founded by BlueSPACE Africa, with strategic co-leadership from ALPi (Africa Law Practice International)

Why SAPA

Africa’s economic potential is held back by fragmented payment systems, FX scarcity, trade finance gaps.

Building an

Interoperability

Financial Platform.

Core Domains of PaFi Infrastructure

PaFi Domain

– Messaging & Interop

– Retail Payments

– FX & Liquidity

– Trade Infrastructure

– Compliance & Trust

– Data & Intelligence

SAPA Product

– SAPAHub, TestHub

– oneWallet

– FX3D, SAPApay

– TradeX, TradeXport

– TrustNet

– DataHub

Role

– Connects RTGS, PAPSS, SEPA, and national switches

– MoMo and QR interoperability across borders

– FX visibility, treasury ops, and multi-currency settlement

– Connects customs, ports, financiers, and insurers

– Shared KYB, AML, and fraud defense across institutions

– Policy, compliance, and liquidity data exchange engine

SAPA

Opportunity Areas

Our Statistics indicate the current

issues across different African countries

Area 1

Africa mobile money

According to GSMA, Mobile Money transactions within African countries is estimated to be $350b across 500m accounts with 5% of it being cross border

Area 2

inward remittance

According to the WorldBank and KNOMAD, Remittance into Africa is estimated at $120b. Most of the MTO’s are siloed. This makes tracking complex and AML difficult

Area 3

intra Africa trade & payments

According to AfrEXIMbank, Intra-Africa trade is estimated at approximately $40b. And most of this trade & payment flows goes through SWIFT, and its 80% manual and siloed. African EXIM banks struggle with trade documentation.

Area 4

international payments

According to SWIFT, capital moving from Africa to other countries via USA/EU/Asia/UK is estimated at $213b. There still remains 180b in trade finance gaps. Huge FX losses for African banks, and huge risk perception

Single Africa

Payment Area

We are on a mission to help Africa harmonize

its trade & payments infrastructure to accelerate a unified Africa market.

Our

Stakeholders

Our users matrix displays the various users’ perspectives that embolden us to go all out.

Our

Leadership

SAPA Overall Impact

Key Impacts of SAPA

Enhanced Financial Inclusion:

– Reduction in the unbanked population from 57% to 30% within 5 years.

– Increased access to financial services for 500 million people, up from 200 million.

Cost Savings and Efficiency Gains

– Annual savings of $5 billion in intra-African trade.

– Annual savings of $30 billion in international trade.

– Reduction in transaction costs from 5-10% to 1-3% of transaction value.

Economic Growth and Job Creation

– Doubling of the fintech market value to $300 billion.

– Annual investment in fintech increasing to $5 billion.

– Job creation in the fintech sector increasing to 1.5 million jobs.

– Annual GDP growth contribution increasing to 3%.

Inclusion of Women and Youth

– Increase in women and youth as financial service users from 30% to 50%.

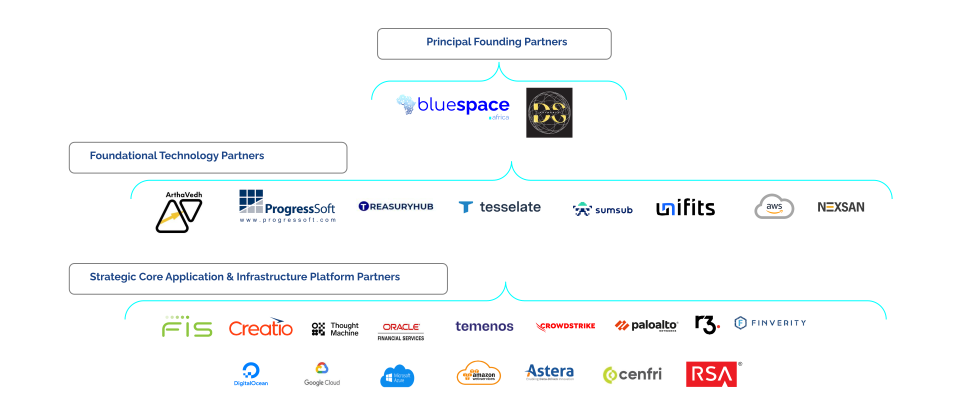

Technology Partners

Powering SAPA